Numlock Sunday: Dave Infante on the trial of the century

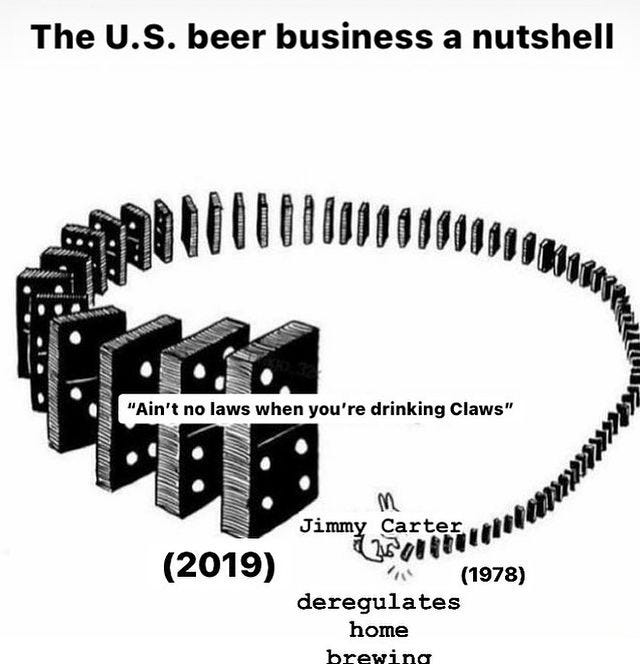

Is Keystone just cruddy Coors?

By Walt Hickey

Welcome to the Numlock Sunday edition.

This week, I spoke to Dave Infante, who writes the outstanding newsletter Fingers all about the alcohol industry. I really love this newsletter, and have been waiting for a chance to get him on to talk about it. Beer is a massive industry, and I love Dave’s work because he covers it like one, looking behind the collabs and the hype to look at the craft beer startups, the colossal juggernauts, and the overall shifts in how this field works.

We spoke about our favorite lawsuit which revealed a number of fascinating secrets about the beer industry, why the bill for a lot of craft breweries is about come due, how alcohol fuels power in America and if Keystone Light is just cruddy Coors.

Infante can be found at Fingers, which I highly recommend, and on Twitter.

This interview has been condensed and edited.

Dave, you write a newsletter called Fingers all about alcohol and the alcohol industry. Before we kind of get deep into it, what drew you to this topic? How'd you become a beat reporter in this space?

Like a dozen years ago, a younger, thinner Dave Infante, with more hair, got into the media business, at a website called Thrillist, which was then a newsletter. It was specifically oriented around telling dudes where to eat and drink in different American cities. I was an editorial intern when I first got hired. I was unpaid, which was more of a thing back then than it is now, and then I just was there for seven and a half years, which is an eternity in digital media.

Over the course of that tenure, I got an opportunity to do a lot of different stuff, and one of the things that I did a bunch of at the food and drink website was start to cover the beer business. I was kind of churning out shitty listicles at first, about best IPAs and things like that, but I knew I wanted to be more of a traditional reporter and beer was where I was getting traction as a young writer.

As you probably remember, I don't know if you had this exact experience, but you fish where the fish are, especially when there's a traffic number on your head. If something's working, you keep doing it, and beer coverage was working. So I was trying to push further and further into it and wound up backing myself into becoming a beer beat reporter without even really meaning to.

I enjoy the newsletter, I enjoy your coverage of the industry, because it's something that people have just an inherent interest in, but it's also extremely complex. Heavily corporatized, yet also full of startups. Very innovative, at the same time it's very stagnant. There's so much going on in it under the hood that I have just really enjoyed your take on it.

One story that hit some of the mainstream recently that you were really on the whole time was this big lawsuit between Stone Brewery and Keystone. Do you want to talk a little bit about what some of the bigger trends in that were?

There were a ton, right? I mean, that was a storyline, and it's still unfolding as we speak, but that was a storyline that kind of wound together a bunch of major strands in the overall kind of narrative about the U.S. beer business.

Stone Brewing Company is out of San Diego; they're one of the pioneering, second wave, craft breweries in the country. They're a top 10 brewery by sales volume for craft brewers in the U.S. In the small pond of U.S. craft beer, they are a big fish, but they're not a big fish when compared to the much bigger pond of the beer business generally. And in that bigger field, MillerCoors is one of the largest conglomerates out there. MillerCoors, which owns Keystone in the U.S., is a subsidiary of Molson Coors, which is one of the largest beer companies in not only the country, but the world.

You're talking about a pair of parties that are orders of magnitude separated in terms of the amount of volume that they're producing, and in terms of their footprint for selling their various liquid wares. What brought these two companies together and ultimately led to them winding up in front of a jury trial in early 2022? Keystone, which is a what you call a "sub-premium brand" in the business, or "value" typically you'll hear people say, it's basically like the swill that college kids are picking up by the 30 rack to go play pong with, right? Keystone did a rebrand of their packaging, their "trade dress" it's called. And in that packaging, they made the part of the word "Keystone," they made "stone" very big, it was all caps. It was very prominently displayed on the cans. So it said Keystone, but it really said, KeySTONE.

And Stone, the craft brewery, took umbrage to that. Stone is, over the course of their history going back about 20 years, has been extremely, extremely litigious in order to defend what it sees as its rightful trademark over the use of the word stone in marketing beer products. At first I think everyone kind of expected this to play out pretty quickly and quietly. Molson Coors, typically a big corporation like that is going to try to get something like this to go away because they don't really — if the lawsuit has some validity, but it would be more expensive to follow through to arbitration or to court, they're going to try to make it go away by settling. It did not wind up settling. Both parties decided that they wanted to ride this thing all the way through.

And over the course of four years, we finally wound up with a jury trial. And in it, Stone convinced an eight-person jury that their mark had been infringed by Molson Coors' Keystone redesign. That was a big shocker in the beer industry world. That was not something that I think a lot of observers expected out of that outcome. I spoke with sources who are trademark lawyers and, they weren't flabbergasted and like this is unprecedented, but it was certainly a surprising outcome.

I want to hang out here real quick. You at Fingers got a ton of traction out of this jury trial because it involved a lot of beer executives having to go on the stand and say things that they normally wouldn't say. What were some of the fun things that you were able to get out of it?

I want to give credit to Courthouse News, who was all over this story and actually had a reporter Bianca Bruno who was getting terrific quotes and was really all over the case. What happened was, as you have this jury trial playing out, all of this stuff is going on the record, obviously even pretrial discovery was really interesting and you're seeing the corporations have to reveal how they think about their products, how they think about their customer bases, what their marketing strategies are and so forth.

One of the funniest things that came out, I think that has ever come out in terms of beer industry litigation, or at least as far as I've ever seen, is that one of Keystone's arguments for why this wasn't infringement on Stone's trademark is because Stone is a fairly high-end craft beer, right? They sell IPAs for whatever, eight bucks a bottle, or it's a premium beer. Whereas Keystone, as we mentioned earlier, is a value beer, is a sub-premium.

You actually have this moment in the courtroom where Molson Coors' lawyer is saying, "The products are not remotely in the same price range. We're not marketing to the same people. These are different beers sold to different people." And to prove his point, he cited that more than half of Keystone Light customers are not working, and 25 percent of its customers make less than $30,000 a year. So the argument was basically there can be no confusion because anyone who's drinking Keystone is too poor to afford Stone, so they would never!

A ridiculous thing to admit on the stand.

And that was their defense!

You got a ton of material out of it, basically. They even had to address the pervasive rumor that I, for one, spread for years, that a Keystone is just a cruddy Coors.

Yeah. It's funny that you heard that. I had also heard that. I went to school in the Northeast and then in Virginia, but definitely always along the Eastern Seaboard, and as you probably know, and your readers probably know, Coors is based in Colorado and prior to the merger with Molson Coors, Coors was the proprietor of Keystone. It's a West Coast brand.

Some of that rumor, the further you get away from the brewery, the more a rumor is able to spread. Certainly Coors had a lot of mythos around it, because for the longest time it was not distributed on the East Coast at all. The movie Smokey the Bandit is in part told around the story of Coors being brought to the East Coast.

But the rumor is that both Keystone and Coors are actually the same beer coming from the exact same tank. And they get put on the line, and the can gets filled, and only when some quality control threshold is failed does the can then get labeled as a Keystone rather than a Coors. That was the myth that I had always heard, and supposedly there's a dent in the bottom of a Keystone can that can show you where on the filling line, it gets nudged off into Keystone trajectory instead of on the Coors Light trajectory.

That part, that sort of more cinematic description of it, I think, remains untrue. But! The underlying core idea, which is that the beer gets brewed more or less in the same vat and is just different parts of the same batch? That actually turns out to be more true than I expected. That's one of the things that came out in testimony, was that the beer is coming from the same tank. There are lawyers and experts from Molson Coors who are testifying to that under oath.

Incredible. I'm so happy this thing went to jury.

I also want to back out a little bit, because again, as entertaining and fascinating and at times surprising this trial was, it does belie some broader trends in the beer industry. I know that you've covered the craft beer industry quite a bit, and one thing that you've been sounding the alarm on is that this trend was fueled by a lot of investment capital and in some cases, even with Stone, you might actually see a period of time where there are some struggles for the craft beer industry because some of the bills that it cost to get it started up are about to come due.

Yeah, that's exactly right. The situation with Stone, I think, is a good example of what's going on with the broader craft beer industry. In Stone's case, the trial I would say like pretty definitively went in their favor, they won and the jury awarded them $56 million worth of damages. They're currently in the process of trying to increase those damages treble as well as reap the attorney's fees. They could be in line for a pretty big pay day. But what we need to keep in mind is that Stone has a $364 million private equity bill due in 2023 with one of their major investors. That's still looming. Even though there's victory in court, this victory won't reverse the trend of Stone sales over the course of the past few years. I mean, they're hemorrhaging sales in many key categories.

That storyline, I think, absent the trial and absent some of this colorful detail that we get in the courtroom scenes, I think is the bigger story with craft beer, which is that the industry has matured an enormous amount over the course of the past five years. We're talking about we have about 9,000 breweries in the country now. There's more competition than ever for shelf space. There's consolidation in the middle tier, which is the beer distributors, which is the legal middle man that is required to get beer to market. There's less access to market in many cases.

When you have stiffer sales, you have more competition, you have rising new categories, like hard seltzer and ready-to-drink cocktails, you're going to see an impact on sales. If your growth projections to your investors said they can expect an 18 percent return or a 25 percent return on a five-year time horizon, on a 10-year time horizon, and then you start falling behind those growth projections, it gets pretty ugly pretty quick, Walt.

One thing that I've enjoyed about your newsletter in particular is again, even if you were just kind of a casual fan of the alcohol business, it is very fascinating times, and it really is super pertinent. I'd love to just kind of hear, bigger picture, what else has your attention right about now? What else should either fans or folks working in the world get on their radar?

I mean, I think something that I'm really interested in continuing to unpack is that middle tier, the distributor tier. Now this is not sexy and I'll warn your readers straight off that this is probably the most weedsy stuff that I get into, but it's one of those areas that I think you do a really good job in Numlock of kind of demonstrating the ways in which these maybe unknown or underappreciated little categories or little business areas can have massive impact on the way broader markets are shaped. Distribution is something that every alcohol supplier, a brewery, distillery, a winery, they all have to go through a distributor to get to market. And that gives those distributors an enormous amount of power and they use that power in different ways.

Not so long ago, we got a big exposé out of Albany where, thanks to some great FOIA work by a reporter at the Albany Times Union, he obtained a trove of emails that demonstrated the way in which Southern Glazers, which is the biggest distributor in the country, is just using campaign donations and fundraisers for key politicians in order to advance its agenda at the state house in New York. That stuff happens Walt, certainly, but I think what we often forget or what I'm always trying to do with Fingers is make sure that readers remember that it's not just the fossil fuel companies or Big Auto or Big Tobacco that use its economic capital to translate into political capital; Big Alcohol and Big Beer use its power very similarly.

It's really important to remember that even though we have personal emotional connections to beer, to spirits or to wine as drinkers, that these businesses that produce those beverages are going to operate the way any other business does. That's the thing that I'm always trying to hammer home is, like any other business, it’s operating on the basis of profit seeking, rent seeking and consolidation and amassing of power. It's really, I think, fun and important to connect the dots, to make sure that you kind of keep that in mind so you can make the choices about what you want to drink.

The intersection of alcohol and political power is the kind of story that I've only been really seeing out of Fingers these days. You can see across time, like John McCain financed a lot of his career through his wife's alcohol business. There's a number of Senate candidates, one I believe in Missouri, somebody just threw her hat in from a beer dynasty.

That's right. Budweiser.

Just to your point, this is becoming a huge part of national politics, even if it's a little off the radar.

Yeah, and I think it always has been. Pete Coors in 2008, who's a scion of the Coors family, obviously, he ran a pretty closely contested Senate primary in Colorado, basically purely on the name recognition of his family and their money and the political tradition of the Coors family, which is ultra-conservative. Joe Coors, who's the patriarch of that family, wrote the check that started the Heritage Foundation. Even though again, they make products that we like and products that have emotional resonance in our lives, it's important to remember that at the end of the day, your beer money is quite often funding businesses with their own goals and with their own incentives that may or may not align with your own.

Amazing. Well, so the newsletter is called Fingers. Where could folks find it? What's your pitch for it? I guess just where can folks find you and your work?

Yeah. Fingers is an independent newsletter about drinking in America. It's at fingers.substack.com, obviously.

If you want more of my off-the-cuff thoughts, you can follow me on Twitter @Dinfontay. I'm tweeting there more than I ought to be, over on Elon Musk's favorite website. Of course, by the time this gets published, who knows, maybe he'll withdraw his bid, we don't know what's going to happen there.

This is being published in three days and genuinely we have no idea of what's going to happen.

I think, the newsletter and Twitter are the best places to find me.

Incredible. All right. Dave, thank you so much for coming on. I appreciate it.

Thanks so much, Walt.

If you have anything you’d like to see in this Sunday special, shoot me an email. Comment below! Thanks for reading, and thanks so much for supporting Numlock.

Thank you so much for becoming a paid subscriber!

Send links to me on Twitter at @WaltHickey or email me with numbers, tips, or feedback at walt@numlock.news.

Subscribed to Fingers. It's tremendous!! Any word when Hard Mt. Dew is expanding to other states? Though a road trip to Tennessee, Florida or Iowa just to get Hard could make for an interesting blogging project or something, especially when I really just want to try it and will probably never drink it again (though I think I would bring it to every get together or party I go to for at least a year).