By Walt Hickey

Welcome to the Numlock Sunday edition.

This week, I spoke to frequent Numlock guest Joanna Piacenza of Morning Consult, who this week published a deep report about travel and trust in the wake of COVID-19. Here's what I wrote about it:

Pre-pandemic, 51 percent of business travelers took at least four business trips per year, and a new survey from Morning Consult found that figure dropped to just 31 percent during the pandemic. A third of business travelers did not travel at all since the start of the pandemic, and that’s been brutal for the hospitality industry because many airline and hotel balance sheets simply can’t work in the absence of reliable business travelers. The good news is that 58 percent of business travelers said they planned to travel for business at some point this summer, which would bring a needed boost.

The report is fascinating, and puts hard numbers to a whole suite of changing views about how Americans think about travel in the wake of the pandemic.

We spoke about why the Herculean steps taken by airlines and hotels resulted in a net gain in trust over the course of the pandemic, why cruise companies are in such a difficult position and the eagerly-awaited return of business travel.

Joanna leads industry intelligence at Morning Consult, she can be found at their website and on Twitter.

This interview has been condensed and edited.

Just this past week, you published a super deep look at the travel industry at a time that I think a lot of people are real interested in what's happening with the travel industry. Want to explain why you wanted to do this topic first and what drew you to the state of travel in the States?

You kind of nailed it on the head there, it's a travel season like no other, right? This summer travel season, people are out, people are ready to vacation, but at the same time, I don't think that we've really paused and thought about the anxiety that encompasses a lot of consumers right now. Because of that, we wanted to go into the field and figure out consumer trust, because a lot of that anxiety is going to be in the hands of travel brands as people get on trains, rent their RVs, get on airplanes, and one small misstep from an airline or a travel brand could be pretty bad for their brand reputation.

We wanted to figure out how consumer trust is built, how it's broken, what the current state of it is as we're in the midst of a global pandemic, so it's a continuation of a lot of the kind of trust work that we've been doing at the company.

These results are really remarkable. You have the net trust for airlines, hotels, casinos and resorts going back to at least 2018. And over the course of 2018 and 2019, it was rather flat, people tended to trust things a little bit. At the start of the pandemic, back in March, we saw a decline in trust for these institutions, but then last summer, you saw something really remarkable happen, where they not only got it back, but they got it back even more. Do you want to talk a little bit about what you observed and kind of the broader contours of how people feel about travel?

This is one of the datasets that I pulled and then checked it and double-checked it. You know what I mean? You're like, "This has to be wrong. There has to be something here." But if you look at this trend line on this report, you'll see that when the pandemic starts, it starts to tick down consumer trust for the airline industry, and the hotel industry just starts kind of this slippery slope. It doesn't really stop until summer of last year.

Then it rebounds, and it rebounds pretty dramatically. The thing that I would kind of ascribe that to is all of the policies that a lot of airlines and hotels really started to embrace and implement last year, last summer. I'm talking about blocking out the middle seat. I'm talking about employees wearing masks and requiring customers to do the same, putting up signage about sanitizing high-touch areas. These policies became so much a part of our experience with these brands, and they really started to build back that trust in ways that didn't exist before the pandemic. So, it was very odd to see collectively, as a whole, this entire industry kind of exiting 15 months of this with higher trust. But that's what our data says.

It's interesting to me because, again, it was a ton of work. It was a ton of money. It was a ton of stress. It was an effort, and it is just really interesting to see that on a level, it was really worth it.

Even setting aside the positive public health benefits, it's almost like the old Tylenol story, right? Where there was an issue with Tylenol. They ripped it off the shelves. And then they exited the process even more trustworthy.

Okay, I want a podcast on that. I want to listen to it, I've not heard that story before. This is just proof that a lot of travel brands were really mindful during this time, listening to their consumers, trying to be extra careful, taking it step-by-step, and it paid off.

One of the things that I'm going to keep my eye on is now that things are returning to something that resembles close to normal, where does that consumer trust go, and how is it correlated with some of these policies being loosened? We all know that the middle seat being blocked off is no longer a thing, which I think we're all really upset about. But will hotels keep putting up signs kind of marketing that they regularly sanitize high-touch surfaces? I don't think that's going to go away anytime soon, and I don't think it should. I think it still really builds consumer trust.

One thing that I really love about this is that you basically investigate what are the points of pain that cause people to lose trust in institutions. I really like this because it seems like in travel specifically, more so even than dining, there's just such an aversion to bad experiences.

There's a reason that TripAdvisor is so popular, and that is that people really don't want to have a bad vacation, in a way that maybe sometimes people are willing to tolerate a rough meal. You have a chart in here that talks about the share of U.S. adults who say that they would stop purchasing from a travel and hospitality brand if it did one of the following things, and I would love to hear just kind of from your findings, what are some of the breaking points for people?

Yeah, this is a category I called trust benders, which is actually a phrase I did not get okay-ed by anyone above me. So, we're just going to put a trademark after that.

Yes. Official TrustBenders™ by Morning Consult.

I need more supervision. So, trust benders™ and trust breakers.

The trust benders are the things that would impact trust among consumers, but wouldn't necessarily cause a consumer to walk away and never come back. Among the biggest trust benders, this is the share of U.S. adults who said they would stop purchasing from a brand if it did the following, mistreating luggage or possessions, having surprise fees. We've all experienced that. Bad customer service, not following clear safety precautions, data breaches, not being reliable, and not regularly cleaning or sanitizing.

I want to kind of pause on that last one because I think that it seems natural for us to have that policy be within the top ten, be within the top 5, but it really isn't. Cleaning and sanitizing, although an incredibly important policy that every consumer-facing brand should follow, was not necessarily as important pre-pandemic. The thing that I take away from this is that the pandemic is still very much top of mind for consumers. These travel and hospitality brands as they're welcoming folks into their hotel lobbies and into their airplanes, one of the things that they may not realize is that this is the first time these people are entering these spaces after months. What are the things that you can do to make them feel really, really safe? That is regular cleaning or sanitizing.

The other thing that was really interesting about this trust benders list, and I think it's something you and I have talked about before, is that getting political or taking a political or social stance that a consumer disagrees with, that was pretty low on the list! There's been a lot of ink spilled about brands taking stances and what you should do and how you should navigate that. I am guilty of spilling some of that ink! I've written a lot about brands getting political, but I think it's a really good gut check to notice that this is at the bottom of the list. There are the normal keeping me safe, keeping my data safe, being a reliable brand that are hitting the top of the list that I think that these travel brands should really be paying attention to more.

We've definitely talked about this a couple times, because it is just so interesting and there is so much consternation about it, people psych themselves out over, "Is my corporation saying or doing the right thing?" But realistically, at the end of the day, and this data really bears it out, there's a baseline expectation of the customer service, and a lot of the rest of it is just kind of aesthetic.

I even thought it was remarkable that you asked about data breaches on here. I know that that's a little bit timely, I suppose, but people are vastly more ticked off if you have a data breach and their data is unaffected than they are if they take a particular stance on a social issue that you're not cool with, right?

I'm really happy that that kind of different phrasing made the list, that "there was a data breach and your data was impacted," but we also asked the question "there was a data breach and your data was not impacted." The latter still bends trust at a higher rate. Thank goodness your data was not compromised, but what that does is it tells you that this brand that you had your trust in before might not be able to protect some of your most valuable assets.

This is all very cool in the context of it, but what really hammers it home is that you actually asked another set of questions, which is basically like if a company goofs up, how do you then act? You found that 88 percent of people will either only use competitor services or use more competitor services moving forward.

It seems like within travel and hospitality that there's just so much competition, that if United burned me once, I will never fly United again. If I had a rough time in a Marriott, then there are plenty of other options. It seems like these companies were really, really assiduous over the course of the pandemic, and I think it's because they're aware of the fact that if they lose a customer, they lose a customer real hard.

I think that's a great data point for a lot of travel brands to just meditate on a bit. It's a very competitive space, especially the airline industry. If you lose a customer, especially if you lose a business traveler, which is just a whole other part of this report, you might not see them again. The one kind of caveat that I want to add to this, and this is also a piece that I did years ago, is that for the most part, consumers have pretty short memories. I did a piece a few years ago about a United scandal when they dragged a passenger off of their flight and that got injured.

We ended up going into the field for a few weeks, I think maybe even a few months after the incident and consistently asked, "Okay, here's a United ticket. It's $200. Here's an American ticket. It's $300," some combination of that, United versus a competitor. Each week, what we saw is that at first, everyone was choosing the competitor, right? No one wanted to choose United. United was dominating the headlines in a very negative way. But as the weeks went on, as the months went on, suddenly those proportions shifted, and consumers were going for the cheaper flight. We also did something with direct and non-direct flights, where the ticket was actually cheaper on United, and it was direct.

Anyway, it was such a cool polling project, but that's all to say that even if a brand gets negative buzz in the headlines, if you're seeing something negative written about that brand, consumers are going to react to it. But for the most part, they do have short memories. Six months after that incident, our data was essentially back to normal.

I want to kind of caveat this again by saying this is something that people are reading about, right, rather than experiencing. If I'm at the front desk of a hotel and I have a negative experience with whoever's behind it, some concierge, that's going to stay with me in a way that reading about how United mishandled an incident, it just impacts folks differently.

The cruise business to me is just super interesting, because you have these very loyal folks, you have these people who are absolutely not, and then you have these folks in the middle that kind of seem to be who the cruises are actually competing for. I'm really interested in hearing a little bit about how the math around cruises is different than hotels and resorts, which are fairly highly acclaimed, and airlines, which people come and go.

Well, I think let's speak from a micro and a macro level, right? So think back to March 2020. I'm going to make you time travel back for the last 15, 16 months.

Yes. March 2020. The biggest story that will happen in March 2020 is obviously the Super Tuesday. That is where my head's at.

Always. Political editor. I mean, gosh, can you believe that? That was happening, too.

But the cruises, I guess, are what you're getting at — I remember that was just like, "Oh, there's a new disease on cruise ships. That's not great."

Yes. Cruise ships had a very, very early and public presence with the pandemic. I think it was Diamond Princess that was off the coast of Southeast Asia in which there was hundreds of cases. Remember?

There was a boat that they just wouldn't let show up anywhere, right?

Yes, exactly. I think we forget that, but maybe it's still kind of in our subconscious.

It totally did.

Because of that, because of that connection with this virus that has upended the entire world, cruises have a very, very long runway to recovery, much longer than airlines, much longer than hotels because of kind of that connection. The other thing to keep in mind is that cruises overall, similar to airlines, require a little bit more consumer trust, simply because of the nature of the business, right? You're in a vessel in the ocean for a long period of time. You have to put your trust in a specific brand, in a specific staff and team in a way that you don't necessarily have to if you're checking into a Best Western or taking a two-hour flight. Airlines, it's a little bit different as well. But cruises, there's a bigger commitment there personally, I think that that really impacts consumer trust. If you look at the report, throughout the report, cruises have a higher standard when it comes to consumers. I think that's largely because of the pandemic and just the nature of the business.

It's like it's a hotel that you are unable to physically exit.

You should do marketing for them. Yeah, that's a great.

"Come on a Disney cruise, it's a hotel that you're physically incapable of exiting."

We'll sell out the first night.

You did mention business travel a little bit earlier, you have some really good stuff on that in this report. You mentioned that about 51 percent of business travelers before the pandemic were traveling at least four times a year, and that is now down to 31 percent. 34 percent, about a third of business travelers have just been sidelined the entire pandemic. You can see it in any city urban core. I was in Midtown recently and some places are a bit of a ghost town, in large part because the business travel is just completely undercut. What's going on with that? You seem to have some signs of a positive development on that front?

You already noted kind of the 20-point difference between people who said they had traveled at least four times a year. Business travel all but came to a halt, especially on airlines. I know that a lot of folks were still traveling via car for business. But looking ahead, 58 percent of business travelers said they plan to travel for business this summer, and then 62 percent said the same of fall and winter.

Now, this is a really important demographic for the travel industry, and anyone listening in the travel industry knows this and is probably getting excited about that number, and they should be for a lot of reasons. Business travelers make up, depending on the mode of transportation, anywhere from 10 to 15 percent of travelers, but they make up a majority of revenue. They are not spending their own money. They are spending the money of corporations. They can buy that $25 burger at the airport. I never could.

They got those per diems.

Right, God, I love a good per diem. But they make up a majority of their revenue within the travel industry. They're so important and key, one of the things that's also sprinkled throughout the survey is the survey overall looks at US adults, but within it, we're able to cut out business travelers. How important is trust when business travelers are making decisions? It's more important among business travelers than compared to US adults. Are business travelers more likely to stray from a brand if that trust is broken? Yes. Everything is a little bit more capitalized and saturated with business travelers.

They spend more, but if you break their trust, they're more willing to walk away. So it's wonderful that they're coming back, it's great news for the industry that a majority of them will be traveling this summer, fall, and winter, but it is also something that should keep hotels and airlines on their toes. You are welcoming back a demographic that is much more picky and fickle when it comes to their experience with your brand.

That is just kind of really good news, because, again, the balance sheets for a lot of these companies just simply don't work unless you have business travel built in.

This is one big recent report, but you guys have been very, very busy at Morning Consult. As I understand it, you're now a mythical creature known as a unicorn. Is that right?

We are. Thank you very much. So, we're all going to go get unicorn tattoos.

Amazing.

I'm going to throw some time in people's Google Cal. We'll figure it out. Everyone's going to be so upset I said that. It's fine.

Guaranteed, lock it in, unicorn tattoos. What have you got cooking this summer? I know that you guys have been able to have a lot of ongoing trackers of the pandemic and kind of attitudes toward it, and some of the most encouraging kind of news has been, I think, from y'all, because the nice thing about polling is you do kind of get a sense for where things are going. It's been really encouraging, in the back nine of the pandemic in the United States at least, it has been a good indication of comfort levels somewhat getting back to normal.

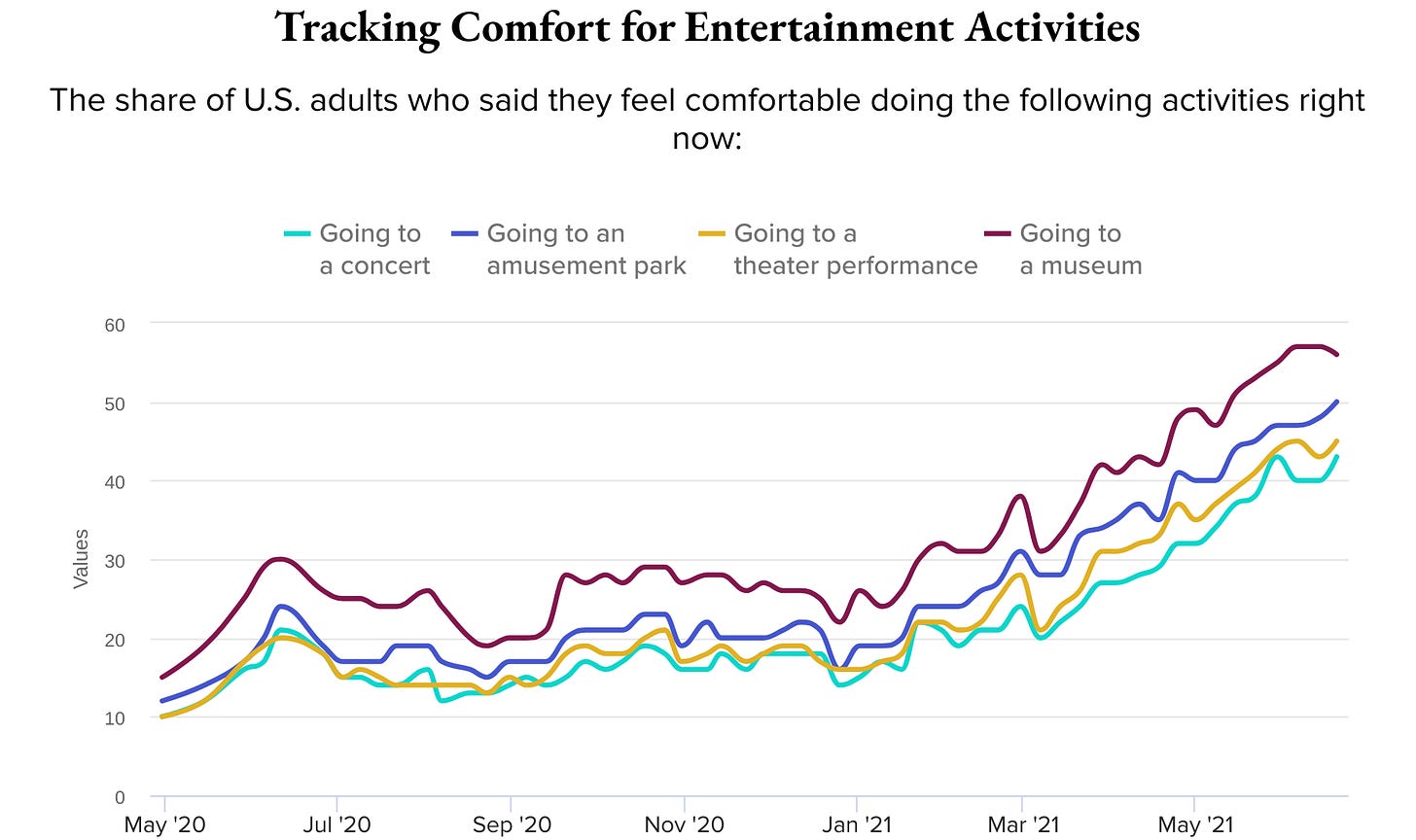

We're going to have a busy summer, to be quite honest. No traveling, but yeah, we have a busy summer at our team and within our company. We've been tracking kind of this return to normal data since early 2020. I don't know the exact date, but I do know when we hit one year of tracking, I ended up sending our lead writer some flowers just to thank her, because every week, she had to look at consumer comfort, which in the middle of a pandemic can be a rough thing! But we have I think at least 15 months of data on consumer comfort levels in going to the movies, dining out, going to a shopping mall, going to a sporting event, Olympics, we update those every week.

We're looking to this summer do some deeper dives into that share of people who are not yet comfortable doing stuff. That's kind of an interesting and exciting change for us, because we've just reached the point where a majority of people feel comfortable doing almost all of our leisure activities listed. Now we're left with this 25 to 32 percent who don't feel comfortable going to the movies, who don't yet feel comfortable going to a museum. Who are they? Why don't they feel comfortable? Are they vaccinated? We want to learn more about that group. We've got a lot of data to go through, so look for more stories on that.

In addition, ahead of back to school season, we'll be releasing a report on commerce. So, I went a little crazy with my online shopping the last year. I'm not sure if you did, too.

I have a lot of possessions that I didn't necessarily think I would be the kind of guy who has. A vegetable slicing mandolin! I emerged from this pandemic really into that. So, yeah, I did hit a little bit of the online shopping. I would agree.

You love to see that sort of thing. I think I saw a TikTok where it's constant, constant depression, and then a package arrives and you're happy for 30 seconds. Then constant, constant depression, which should tell you a little bit about my TikTok conventions. What our commerce report will do is investigate consumer trust, again, trust is a big thing for Morning Consult. We keep putting out these deep dives into different industries, but consumer trust in terms of online shopping. So the pandemic forced a lot of us online to get the goods that we needed and maybe in your case, the goods that you didn't need.

A lot of those!

I think that there's a certain demographic that was always used to shopping online, but millions of others were not. They were forced to download grocery apps or order things that they normally would've picked up at a brick and mortar store. Now that those habits have been somewhat formed and now that things are opening back up again, what happens to those habits? Did they build enough trust with this online supplier that that's going to be the norm moving forward for them?

Those are kind of the questions I want to answer, and I think it'll be really interesting with the back to school season. Do people want to head to Target and get in line and do their back to school shopping in person, or have those habits been formed to the extent that you're sitting on the couch, looking at your phone, boop, boop, boop, done, online school shopping done?

I think that one thing that I've enjoyed a lot about your coverage is that it has been a big question about what is going to endure from this in a way. A lot of changes were made with regards to how people work, how people commute, how people travel, how people do all that. Some of them seemed extremely temporary and extremely desirable to remain temporary, but a lot of them just seem sticky, and it's going to be really interesting to see how this happens. I'm just very grateful that you guys have been kind of running these recurring trackers because I think that they are just such a cool little scientific component.

Absolutely. Have to look to the past to look to the future.

Where can people find the report? Where can folks find you?

MorningConsult.com. You will find the trust report on our homepage, and you'll find our other kind of deep dives in financial services and see what else is to come the rest of the year and @morningconsult on Twitter, and got to pitch myself, @jpiacenza on Twitter. I tweet out lots of pictures of pasta.

Lots of pictures of pasta.

It's a lot. It's a lot of pasta.

If you have anything you’d like to see in this Sunday special, shoot me an email. Comment below! Thanks for reading, and thanks so much for supporting Numlock.

Thank you so much for becoming a paid subscriber!

Send links to me on Twitter at @WaltHickey or email me with numbers, tips, or feedback at walt@numlock.news.